Here’s a summary of an analysis I did to understand the impact on me (as a grid-connected solar member) of a recent change in rates at the electric coop (Riverland Energy Cooperative) that I belong to.

My conclusion in a nutshell: I accept the new rates as they stand. They seem fairer to coop members as a whole and I’m happy to carry the impact that my solar panels have on our shared infrastructure.

I looked at three rate-change puzzlers: Demand Charge, Annual to Monthly True-Up and Rate of Return. The rest of this post goes through them at a high level, and there’s an 18-minute video at the end that goes into more detail.

UPDATE: There is a new version of the spreadsheet and an additional video on how to use it at the very end of this post.

Click HERE if you would like to download a copy of the original spreadsheet I used to analyze the impact on our bills. Go to that one to check my work. Details are in the first video. Contact me if you have questions or want some help.

Demand Charge

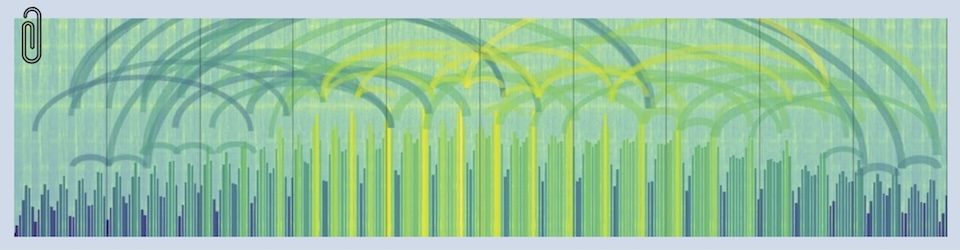

Riverland Energy Cooperative (aka REC) recently introduced a monthly demand charge for all members. It differs from old style (prior to residential solar) Demand Charges in that it is based on the highest flow in either direction – peak demand or peak production. It’s calculated by finding the highest demand or production rate, averaged over a 15 minute interval and multiplying that number by a dollar to arrive at the monthly charge. Here’s a typical month for me (October of this year):

My conclusions:

- Demand charges help build/maintain infrastructure

- I make large and unusual demands on that infrastructure because of my grid-connected solar

- Seems fair that I should pay for that privilege.

- Looks like it’s never above $20/month total

- It’s only $5-$10/month more than I’d pay if I didn’t have solar

Annual to Monthly True-Up

This is the puzzler that got me started on this project. I was curious to see what the difference would have been had this approach been in effect over the years that I’ve had solar connected to the grid. It took me a while to put this together and my Hero of the Week, Scott Hayes from REC, checked my math. He and the rates folks at the coop gave me a thumbs up on this part of the analysis.

Here’s the punchline page. The “Old minus New” line is the one that shows the difference the new rate would have made.

My conclusions:

- Fairer to both sides – reduces risk of mispricing credits

- Simpler for members and the accounting dept – eliminates the month to month “banking” accounting

- Minor impact on monthly cost (at least to me)

- My numbers may not be representative – you can try your own if you want

- Best time to switch to new rate – seems to be the annual “true-up” month

Rate of Return

Here’s a simple analysis of how the change to true-up would change the rate of return on the panels. I calculated how much my kilowatt-demand charge would have been if I didn’t have the panels (the top row), compared that number with what I would have paid under the new rate and what I actually paid under the old rate (the middle two rows) and what the difference would be (the bottom row).

Note: Scott Hayes and I are having a friendly argument about that top-row number – I’ll update it when we settle. Again, details of the calculations (and how you can do it yourself) are in the video that’s coming up Real Soon Now.

My conclusions:

- My rate of return on solar panels is negative – I’ve spent way more than I’ll ever recover. Fortunately, that’s not why we put them in – we do it mostly to reduce our carbon footprint and provide convenient whole-house backup power.

- The overall impact is minor – less than 10% change in cash flow

Video

Here’s a video that goes into about 18 minutes of detail as to how I got to those final pages

UPDATE – 12/16/24

I’ve revised the spreadsheet to make it easier for folks to use. Click HERE for the new version. And here’s a new “how to” help-video that goes with it.